Egmont’s Emily Campan on why publishers have come to rely on the classics in their portfolios.

Classic characters are big business in the children’s book market. At the end of 2018, only one brand in Nielsen’s top ten had a sales history of under a decade, and the only brands to see growth were ‘classic’ children’s brands, with roots in literary properties. While the likes of Star Wars and LEGO faced double-digit decline through Bookscan, Beatrix Potter and Dr Seuss saw double-digit growth.

The longevity and appeal of publishing around brands like Peter Rabbit and Mr Men Little Miss is not news, but the children’s book market’s dependence on them, and their buoyancy in the face of some thoroughly modern challenges, is a new development.

Classic character brands, with years of heritage and nostalgic appeal behind them, have never been more important to publishers and retailers. Their stable revenues and evergreen appeal provide a profitable cushion for the industry − important when the success of even the hottest licensed properties is by no means guaranteed in books.

It’s clear why publishers have come to rely on the classic brands in their portfolios. Of the top 20 book brands in 2018, 11 were based on literary properties with nostalgic appeal, seeing over £31 million in sales through the tills between them.

And Bookscan is only half of the picture; non-traditional book retailers, book clubs, the value market and English language export retailers all buy into, and depend on, classic heritage properties. You’ll find Winnie-the-Pooh or Mr Men Little Miss titles year-round in nearly every conceivable retailer of books; from Poundland to Selfridges, via the book trade, grocers and independents. Underpinning this enviable cross-market appeal are a broad range of price points; ranging from a £1 picture book through to £200+ boxed sets. Their stability and wide-ranging appeal mean they’re considered lower risk than other licensed titles, so that as space at retail is increasingly squeezed it’s these safe bets which often end up the last man (or rabbit) standing.

Classic heritage brands obviously don’t just appeal to buyers. Their confidence is shored up by years of long-term appeal to, and good faith from, consumers. For many parents, carers, grandparents and gifters, books which are now considered classics were a cornerstone of their childhoods. 51% of consumers who bought Mr Men Little Miss books last year did so because of their fond memories of reading them as children.

Classic characters’ nostalgic appeal transcends demographic, geographic and generational differences in a way that more modern brands often don’t. Their history makes them inclusive; a reassuring and safe purchase in uncertain times.

A handful of more modern publishing mega-brands are making their mark and building to classic status. David Walliams, The Gruffalo and the Oi! series are all well on their way to becoming cross-category classics, while Peppa Pig and Harry Potter are arguably already there.

Key to this success is publishers’ ability to spin the original content into new formats and titles. None of the market’s top classic character brands rely solely on the original titles which made them national treasures. What you do with a classic brand once it is established is critical to its longevity. An example of this is our own Mr Men Little Miss Adventures range, which has sold 112k copies through TCM to date.

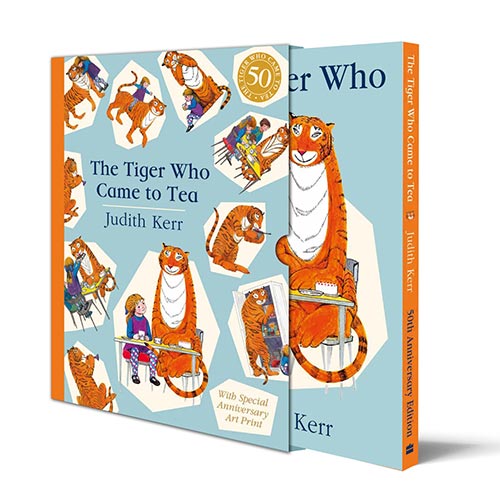

Also key to the success of heritage brands is the fact that their popularity is not limited to books. In 2018, most of the brands in growth had a major movie or cross-category anniversary moment. Dr Seuss sales jumped 25% following the release of the Grinch movie in November 2018, and The Tiger Who Came to Tea celebrated his 50th birthday with a 25% sales jump, too.

Looking forwards, we can expect to see more anniversary boosts, as Thomas turns 75 in 2020, Mr Men Little Miss turn 50 in 2021 and The Cat in the Hat turns 65 in 2022. The success of Paddington, Peter Rabbit and Winnie-the-Pooh at the box office make follow up movies very likely, and future productions of other classic literary properties almost certain.

These attention-grabbing moments mean we can expect continued success of classic characters within the licensed space over the next few years.

(All figures based on Bookscan).

Emily Campan is a publisher at Egmont, a leading specialist for Children’s books. Among her wide-ranging portfolio, Emily is publisher for Mr Men and Thomas the Tank Engine. Egmont is home to three of the top ten preschool brands in the market. They are the original publishers of Mr Men Little Miss, Thomas the Tank Engine and Winnie-the-Pooh.