David Riley chats to Nielsen Book International and key publishers about the state of the children’s book market.

Sorry folks, but I’m going to use the ‘B’ word, and perhaps not surprisingly I’ll combine it with the ‘F’ word. “Oh my God, when will the torture end?” I hear you groan… but relax, I’m talking about Books, and the importance of Fiction in the marketplace.

To get an overview of licensed children’s book publishing I spoke to Hazel Kenyon, book research director UK and Ireland at Nielsen Book International. Its research shows that across nine children’s book markets (UK, Spain, Australia, Italy, Brazil, Ireland, India, South Africa and New Zealand), only two markets – the UK and South Africa – were down in 2018, but only by 0.6% and 0.9% in volume sales respectively.

But measuring licensed publishing is a bit like herding cats: you’re never really sure whether you’ve got it all, because different publishers have different interpretations of what a licence is. According to John Packard, publishing director for brands and licensing at Egmont, “whichever way you measure it, the market for character books was down in 2018. Measuring a basket of ten of the top brands you’re looking at around 16% (decline) in RSV.”

So what’s the solution to these wildly different perspectives on the market? The answer, of course is in the mix.

More than 75% of the children’s market is held by four areas: Children’s Fiction, Picture Books, Novelty and Activity books and Young Adult Fiction. The share of these hasn’t changed much in the last year but if you look at the really big sellers, 76 of the top 100 titles were either fiction or picture book titles in 2018, compared to just 39 ten years ago.

A few other points leap out from the data: first, David Walliams and Julia Donaldson remain supremely powerful; second, looking at the top licensed brands in children’s fiction, all but four were down on 2017; third, looking at the licensed bestsellers there was just one fiction title in the top five in 2017, but three in 2018 (2 x Disney Twisted Tales and 1 x Star Wars novel).

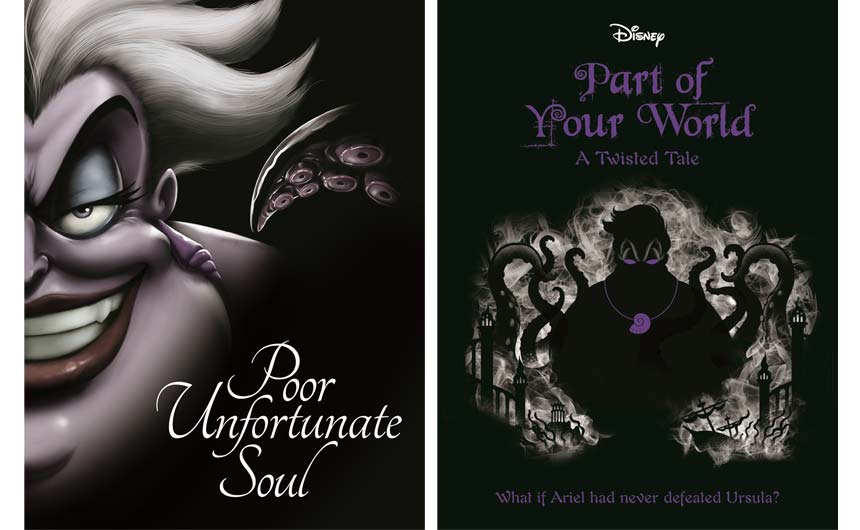

What’s working and for whom? Marvel, Star Wars, Diary of a Wimpy Kid, Harry Potter and Paddington are doing well. Bonnier has been successfully re-releasing the Disney fiction list and adding new titles to its mix, making fiction surpass novelty and activity as the largest category for Disney in 2018.

Here’s Helen Wicks, executive director at Bonnier Books UK: “As recently crowned New Licensee of the Year at Disney, the key to our success has been looking beyond established formats – to redefine and extend the storytelling experience. Our YA fictional re-imaginings, the Twisted Tales and Villains series, have remained strong and sales show no signs of slowing down. We have now sold over a million copies across these franchises – and there are further titles to come.”

Macmillan Children’s Books specialises in classic properties (both literary and licensed). Clearly its publishing is in tune with the market. Publisher Belinda Rasmussen comments: “Macmillan Children’s Books had its sixth year of growth and our best year ever. Strong co-edition and export sales drove our growth in combination with strategic investment in new areas of publishing paying off. Outside the market force that is Julia Donaldson, we were up 4% in a market that was flat and had above market growth in four out of five of the TCM categories in which we compete (Novelty and Activity, Picture Books, Children’s Fiction and Young Adult Fiction).

“A highlight was Rod Campbell. Dear Zoo finished 2018 as the number one picture book in the UK (excluding World Book Day titles) with 114,000 copies sold 11% up YOY. Overall, Rod Campbell’s sales were up 15% in the UK TCM with growth in Classics, Gift and Activity and the growth has continued into this year.”

But the picture for classic characters is distinctly mixed. For instance, The Very Hungry Caterpillar and Paddington appear to be doing well, while two stalwart classics appear to have had a softer year. Egmont’s John continues: “We’re seeing a particularly marked decline in publishing based on TV and film properties. However, heritage characters seem to be holding up well – specifically those based on books in their original format. It is getting harder and harder to launch new properties.”

Two other trends stand out from the data. The first is the importance of non-fiction in licensing. Non-fiction is not a huge category: it only delivered 6% of the market in 2018, but it was up a whopping 33% on the previous year. Here, gaming brands dominate but there’s also a nod to trusted, heritage brands: Roblox, Fortnite and Minecraft, but also Guinness World Records and National Geographic Kids.

The second trend is not really about licensing, but I’m sure it soon will be… unicorns. According to Nielsen 7% of all Novelty and Activity sales were from books with ‘unicorn’ in the title, and Picture Books and Fiction also saw significant sales of unicorn titles. Most publishers seem to have leaped on the back of this particular creature… but dinosaurs, dragons, monsters and llamas are all working their way into print and generating good sales.

And what of this year and beyond?

I’ll leave it to John Packard to sum up: “I reckon preschool TV is going to continue to be tough to translate into books as the audience is much more fragmented than it was in the past – now being across terrestrial, YouTube and other streaming sites. New range launches based on licensed properties tend to be smaller sales-wise than in the past and I don’t see that changing – we’ll inevitably see the number of books for each licence decline each year to match demand.

“Movie tie-in publishing which isn’t supported by a strong evergreen franchise is going to be very tough, too, given some recent flops. ‘Kid-fluencers’ are an interesting opportunity in terms of reach and fanbase and they are appealing to younger and younger fans. The gaming industry is set to overtake sales of music and film, so we should see more and more opportunities coming from that direction for publishing. In summary it’s fair to say there are some pretty significant changes happening in the market right now and the next couple of years will be both critical and really interesting.”

For further information on Nielsen Book Research LAB (Licence and Branding) data and Nielsen Books and ConsumersTM please contact infobookresearch@nielsen.com.

Copyright © David Riley, David Riley Consulting Limited

David is an independent publishing and licensing consultant and agent specialising in book and magazine publishing. Contact him at Davidianriley16@gmail.com for independent support and advice.

This feature originally appeared in the summer 2019 edition of Licensing Source Book. To read the full publication, click on this link.