Kids Insights on the importance of getting your YouTube and social media content strategy right.

What we are seeing is that brands which invest in developing content for social media channels such as YouTube are giving licensing partners a far greater chance of succeeding.

The speed of change in all industries is unprecedented, but we challenge anyone to name an industry which is moving as quickly as the children’s sector.

In 2018 we witnessed some of the most significant legislative changes this generation has seen in regard to marketing to children – with the revolutionary changes introduced through both GDPR and the sugar tax.

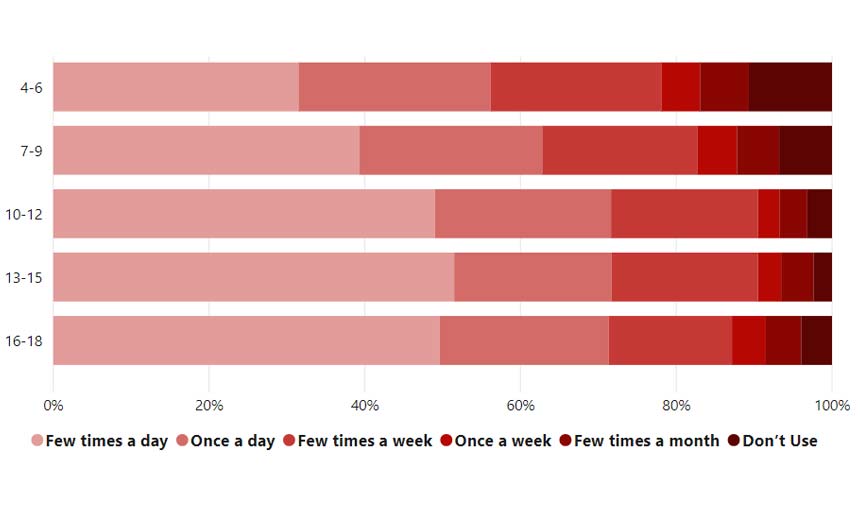

We are also seeing how technology and devices continue to have a more significant impact on the lives of children. While the TV is still an important part of a child’s ecosystem, it is no longer the nucleus, rather, it has been replaced by tablets for younger children and smartphones with older children and that is just the start.

As technology becomes more affordable and powerful, the media which they are consuming is becoming increasingly fragmented. This enables them to have much greater choice as to what they consume and when they consume it, and while our Kids Insights 2019 Future Forecast (free to download at www.kidsinsights.co.uk/futureforecast) report predicted that YouTube was going to decline in 2019, it is still by far the most influential platform for engaging children.

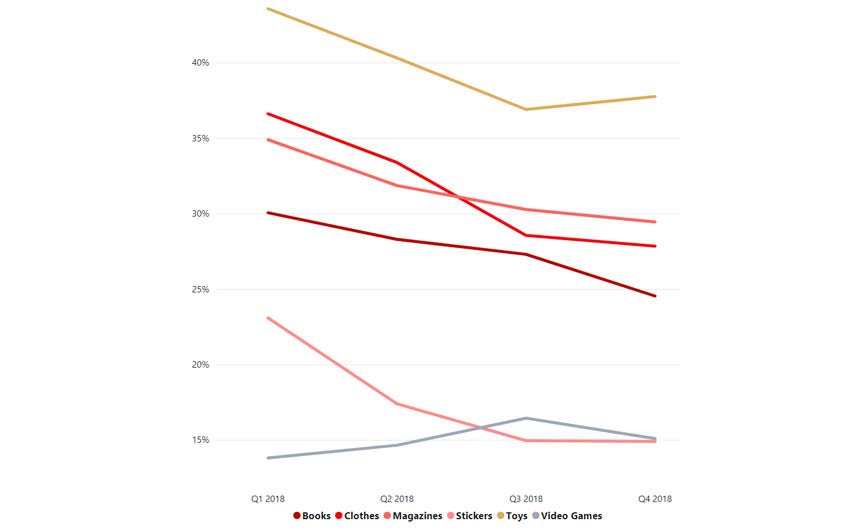

And we are seeing the impact of this in our data, as licensed products related to TV declined sharply declined throughout 2018, with categories such as clothing (24% reduction), books (16% reduction) and toys (13% reduction) not faring well with 9-12s, the biggest owners of licensed products in the UK.

Our data shows that kids aged 4-12 who keep up to date and follow their favourite shows on YouTube, however, are 18% more likely than the average child to purchases licensed toys – demonstrating the need to develop an ecosystem to engage children.

Notably, four in ten children in this age group have purchased toys related to their favourite TV show and three in ten have bought magazines or clothes.

We are seeing examples of brands starting to consider this. MGA Entertainment is expanding its original L.O.L. Surprise digital content beyond YouTube to a number of global OTT channels. The brand will be sharing three seasons ‘unboxed’ and also behind the scenes footage, which will be available on OTT platforms weekly. MGA Entertainment has just broken through the one million subscriber mark on YouTube.

With internet stars such as Ryan ToysReview crossing over into the publishing, licensing, merchandising, toys and even linear TV space – from next quarter, we will have data and insights on children’s behaviour around the purchase of licensed products related to TV.

The future goes beyond YouTube?

We believe – and as we predicted in our 2019 Kids Insights Future Forecast – social media is going to become increasingly fragmented. We have seen in the last 12 months how ‘new’ platforms have established themselves with certain demographics – such as TikTok with tween girls who specifically like music, and Twitch with teen boys who like to game continue to grow at a significant rate.

And with our data showing that video gaming heroes are on the rise, brands should go beyond looking at developing a YouTube ecosystem.

Video gaming heroes on the rise

Pikachu proved his ever-growing popularity by becoming the first original video games character to appear in the top ten, with boys aged 4-12 naming him as their eighth favourite character.

Overall, the Pokémon franchise is a consistent favourite with 4 to 15 year olds, who are fans of both the games and TV shows. That success is set to continue with the Pokémon: Detective Pikachu movie which hit cinemas in May.

There’s a notable link between Pikachu fans and YouTube, with boys in the 4-12 age group being 17% more likely than the average child to visit YouTube multiple times per day.

Pokémon: Detective Pikachu will be the beginning of an exciting chain of films based on video games. Sonic the Hedgehog becomes a live-action film in November, with Tim Miller, who directed Deadpool, as one of the executive producers. Meanwhile, both Minecraft: The Movie and the film adaptation of PS4 game Uncharted are generating hype with fans, but struggling to gain momentum in their production stages.

This demonstrates how important it is to build an ecosystem around TV shows to capture the imagination of the avid fans who seek out extra content on YouTube and like to buy related items.

We are seeing in our data that gaming properties are continuing to increase in popularity, and from April 1 we started collecting data on what licensed products children are purchasing in relating to video game content.

The Insights People specialises in research and insights on kids, tweens and teens. It surveys 1,600 kids, tweens and teens every single week across six countries including the US, UK, France and Germany. Its real-time portal is continually updated to allow our clients to spot the latest trends before their competitors. Its insight-led reports are produced by some of the top kids’ researchers in the UK and have seen it shortlisted for a number of start-up and innovation awards.

For more information on Kids Insights, a sample report and a demonstration of our award-winning portal, visit www.kidsinsights.co.uk/lsb/ or call the team on +44 (0) 330 159 6631.

This feature originally appeared in the summer 2019 edition of Licensing Source Book. To read the full publication, click on this link.