Start Licensing’s Ian Downes highlights his five key observations and trends from another year of looking out.

It’s the time for annuals and almanacs, reviews and reflections, lists and loves. It’s been an interesting year for Looking Out and I have pulled out some highlights from a busy year to create my Licensing Lookout Five – five key observations and trends from 2023…

One thing I have noticed are changes in retail. Of course, we all know that there are challenges in the retail market at the moment, but beyond this I have seen some interesting developments in the retail sector. One of these has been the continuing emergence and importance to licensing of the value retail sector. Retailers like Home Bargains, B&M and Poundland frequently feature licensed products.

Interestingly, these retailers feature licensing in multiple categories including food, drink, gifting, pet products and apparel. More specifically, retailers like The Works seem to be emerging as more significant retail partners for licensing. It is strong in core categories like publishing, toys and crafting. I noticed it has supported certain licensed properties like Peppa Pig in depth and used features like FSDUs to drive sales.

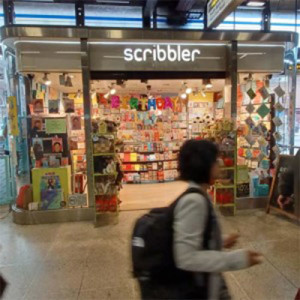

In a related point I have noticed how retailers are using FSDUs, end caps and clipstrips more often to make the most of their space. Another trend I have noticed is an increase in pop-up retailing – for example Miffy had a themed store in London’s Chinatown earlier in the year and in a related development it has been interesting to see retailers like Scribbler invest in smaller retail outlets located in places like Waterloo station – presumably they are trying to ‘fish where the fish swim’ and responding to the changing dynamics of the traditional high street.

In a related point I have noticed how retailers are using FSDUs, end caps and clipstrips more often to make the most of their space. Another trend I have noticed is an increase in pop-up retailing – for example Miffy had a themed store in London’s Chinatown earlier in the year and in a related development it has been interesting to see retailers like Scribbler invest in smaller retail outlets located in places like Waterloo station – presumably they are trying to ‘fish where the fish swim’ and responding to the changing dynamics of the traditional high street.

Another sector of licensing that has had a busy 2023 has been that of licensing associated with FMCG brands both in terms of licensing in and out. It seems FMCG companies trust in the business of licensing more these days. A leading retail player in this mix is Iceland. It has launched new licensed products throughout the year, topping up its standard ranges with interesting and appealing licensed lines. Recently it worked with Mars to develop a range of frozen desserts featuring brands such as Snickers and Galaxy. These have joined more enduring partnerships Iceland have with the likes of Gregg’s and TGI Friday’s.

Unilever has used licensing wisely with some of its signature brands like Marmite. An interesting new addition to the Marmite licensing portfolio has been a deal with oatcake manufacturer Nairns to develop Marmite flavoured oatcakes. This product is a great example of how a licensed brand can make a real impact in a traditional category particularly when there is a focus on branding, taste and flavour.

Unilever has used licensing wisely with some of its signature brands like Marmite. An interesting new addition to the Marmite licensing portfolio has been a deal with oatcake manufacturer Nairns to develop Marmite flavoured oatcakes. This product is a great example of how a licensed brand can make a real impact in a traditional category particularly when there is a focus on branding, taste and flavour.

It has also been interesting to see how coffee chains and Quick Service Restaurants have embraced licensing to bolster their NPD – for example McDonald’s is currently offering a Galaxy Caramel hot Chocolate as part of its Christmas offering. FMCG brands have also switched on to the potential for them to licence their brand into categories like apparel. In retailers like Primark, food and drink brands are a core part of the licensed portfolio with brands like Coca-Cola featuring frequently.

One trend that I have enjoyed seeing is the growing success that music seems to be having in licensing. Band brands are now a key feature in the licensing market. I often see licensed products featuring iconic bands and music artists including the likes of the Rolling Stones. Of course, The Beatles licensing programme is a great example in this category and in many ways has helped opened the doors for others to follow. There is a lot of focus in the apparel category in particular, but there is a presence in a number of other categories such as wall art, gifting and greetings.

One trend that I have enjoyed seeing is the growing success that music seems to be having in licensing. Band brands are now a key feature in the licensing market. I often see licensed products featuring iconic bands and music artists including the likes of the Rolling Stones. Of course, The Beatles licensing programme is a great example in this category and in many ways has helped opened the doors for others to follow. There is a lot of focus in the apparel category in particular, but there is a presence in a number of other categories such as wall art, gifting and greetings.

It is interesting to see new/old bands emerging in the category – I am guessing licensees and retailers are trying to find bands that resonate with younger consumers so we are likely to see more bands who were successful in the 2000s featuring in licensing. There have been some very smart examples of bands being used at particular times of the year, for example Wham and Last Christmas feature at this time of the year. A challenge in this category is that it does seem to be one that is susceptible to unofficial merchandise and brand owners need to be constantly vigilant around this issue.

It has also been interesting to see how bands such as Rolling Stones integrate licensing into their wider activities and how they have developed their retail offering by adding in destination stores.

It has also been interesting to see how bands such as Rolling Stones integrate licensing into their wider activities and how they have developed their retail offering by adding in destination stores.

In the Rolling Stones case they have a fully branded shop on London’s Carnaby Street.

It is also worth recognising the growing success HMV are having. It is a retailer that is using music as a core theme in the stores, both in terms of the merchandise it sells, but also featuring vinyl sales coupled with supporting local bands by giving them stage to perform on.

Live licensing continues to be more noticeable and prominent in the market. It is a category of licensing that I notice a lot on my travels. Licensing plays a role in areas like museums, theatre shows, galleries, concerts and immersive events more often these days. One unscientific measure of this can be found when travelling on the London Underground – there are multiple examples of licensed brands featuring on posters promoting theatre shows and concerts. One of the longest standing examples of this kind of licensing is The Snowman theatre show which has become a feature of London’s Christmas theatre offerings.

A particular live highlight for me this year was seeing the Morph art trail in London. The art trail was developed jointly by Aardman, Wild in Art and charity Whizz Kidz. Morph statues were located around Bankside, the Borough and the City of London. The Morphs featured artwork from a range of artists and illustrators. The art trails act as charity fundraisers, but also encourage people to get out and walk as they explore the trail. For the brand owner they provide a fabulous focal point for a brand drive engagement and create retail opportunities. Being involved in the trail confirmed to me what a great opportunity licensing has in the live sector and I am sure we will see more examples of licensing playing a role in the category in the coming years.

A particular live highlight for me this year was seeing the Morph art trail in London. The art trail was developed jointly by Aardman, Wild in Art and charity Whizz Kidz. Morph statues were located around Bankside, the Borough and the City of London. The Morphs featured artwork from a range of artists and illustrators. The art trails act as charity fundraisers, but also encourage people to get out and walk as they explore the trail. For the brand owner they provide a fabulous focal point for a brand drive engagement and create retail opportunities. Being involved in the trail confirmed to me what a great opportunity licensing has in the live sector and I am sure we will see more examples of licensing playing a role in the category in the coming years.

My fifth and final highlight is to acknowledge the seeming rise and rise of ‘collabs’ or collaboration. Collab deals see licensed brands working with one or more brands most often to create limited edition or limited time products featuring bespoke designs most often coupled with branding from the partner brands. These type of partnerships seem to happen most often in the apparel, accessories and footwear markets. It has thrown up some intriguing and effective partnerships. Sometimes I have found it difficult to decipher the commercial terms of deals like this and I suspect many of them aren’t governed by ‘normal’ commercial terms. As a collective, collabs seem to have succeeded in engaging a broader church of companies in licensing and likewise consumers.

These kind of deals aren’t confined to apparel though, with brands like watch company Orvis getting involved. It has collaborated with Disney for a Muppets watch. Another interesting example of this kind of partnership is cookware brand Ruffoni working with Disney around the 100th Anniversary celebrations. It has launched a range of high-end copper cookware featuring characters like Donald Duck. The purpose behind collaborations seemingly often goes beyond cash and centres on objectives like consumer engagement. It is an interesting part of the licensing market and one of the more challenging ones for a Lookout to fathom. I have often see things in retail and struggled to work out the deal dynamics but have recognised that this way of working has driven a lot of original thinking in licensing particularly around design development.

These kind of deals aren’t confined to apparel though, with brands like watch company Orvis getting involved. It has collaborated with Disney for a Muppets watch. Another interesting example of this kind of partnership is cookware brand Ruffoni working with Disney around the 100th Anniversary celebrations. It has launched a range of high-end copper cookware featuring characters like Donald Duck. The purpose behind collaborations seemingly often goes beyond cash and centres on objectives like consumer engagement. It is an interesting part of the licensing market and one of the more challenging ones for a Lookout to fathom. I have often see things in retail and struggled to work out the deal dynamics but have recognised that this way of working has driven a lot of original thinking in licensing particularly around design development.

To paraphrase Elvis Costello, it has been ‘a good year for the Lookout’ – I look forward to more Looking Out in 2024 – who knows I might see an Elvis Costello t-shirt one day soon…

Happy Christmas to everyone and wishing you all a successful year of licensing in 2024.

Ian Downes runs Start Licensing, an independent brand licensing agency. His Twitter handle is @startlicensing – he would welcome your suggestions for what to look out for.